Located in HCM City, the AAFH will offer policy incentives for aviation finance, including competitive tax policies, liberalised capital flows, multi-currency payments and an international-standard legal framework to protect asset rights.

SINGAPORE — A new aviation financial hub has been launched in HCM City, aiming to mobilise more than US$6.1 billion in initial capital and position the country as an emerging centre for aviation finance in the region.

The Asia-Pacific Aviation Financial Hub (AAFH), an initiative under the Vietnam International Financial Centre in HCM City (VIFC-HCM), was announced at the Singapore Airshow 2026 with the participation of Vietjet and major global aviation and financial players, including Airbus, Boeing, Pratt & Whitney, Rolls-Royce, CFM International and the International Air Transport Association (IATA).

The hub is being established as the global aviation industry undergoes restructuring, with Việt Nam seen as one of the fastest-growing aviation markets in Asia-Pacific.

Located in HCM City, the AAFH will offer policy incentives for aviation finance, including competitive tax policies, liberalised capital flows, multi-currency payments and an international-standard legal framework to protect asset rights.

The hub is designed to operate as a one-stop platform linking aviation finance with airport infrastructure, maintenance and repair services, training, logistics and free-trade activities, with the aim of reducing costs and improving efficiency across the aviation value chain.

By 2035, the AAFH is expected to facilitate around $50 billion in transaction value, creating new investment opportunities in Việt Nam’s aviation sector and the wider region.

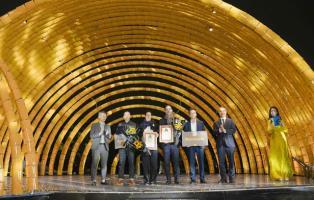

At the launch event, Airbus and Boeing were awarded honorary strategic membership status within VIFC-HCM. Airbus said its participation reflected a long-term commitment to developing innovative aircraft financing solutions and supporting sustainable aviation growth in the region.

Paul Meijers, Executive Vice President of Airbus, highly values the role of the Asia-Pacific Aviation Financial Hub in establishing an effective platform that connects the demand for next-generation fleet development with the global financial ecosystem.

He said that participating as an honorary strategic member reflects Airbus’ long-term commitment to advancing innovative financing solutions and supporting the sustainable growth of the aviation industry.

Meanwhile, Trương Minh Huy Vũ, chairman of VIFC-HCM, said that the launch of the Asia-Pacific Aviation Financial Hub marks an important step in realising our vision of building VIFC into a modern, open, and trusted international financial platform.

"We attract investors not only through incentives, but through institutional quality, innovation capacity, and our ability to directly connect capital flows with the real economy,” he said.

Vietjet - a founding member

The establishment of the AAFH in Việt Nam is supported by aviation enterprises, with Vietjet serving as a founding member and a key source of transaction activity.

The carrier has nearly 600 aircraft on order, one of the largest backlogs globally, generating substantial long-term financing demand.

Speaking at the event, Nguyễn Thị Phương Thảo, chairwoman of Vietjet, said the hub marks a strategic milestone in reshaping how global capital supports the advancement of aviation and the broader economic landscape of Việt Nam and the region.

She added that Vietjet is committed to leading high-impact transactions that help strengthen a forward-looking and sustainable aviation finance ecosystem to support future regional growth.

During the Singapore Airshow, Vietjet signed a series of aircraft engine and financing agreements worth more than $6.1 billion, including a deal with Pratt & Whitney, part of RTX, to supply and maintain engines for 44 A321neo and A321XLR aircraft.

The airline also signed aircraft financing agreements with partners, including US asset manager Pacific Investment Management Company (PIMCO). — VNS