As of May 20, 2025, Việt Nam had 858 enterprises and manufacturing facilities certified to the International Automotive Task Force (IATF) standards.

Compiled by Thu Trà

HÀ NỘI — Việt Nam’s auto parts industry is rapidly emerging as a key player in the region, overcoming long-standing limitations once symbolised by the so-called 'screw curse' – the inability to produce anything beyond basic components. Today, Vietnamese manufacturers are producing a wide range of advanced components, including electric motors, cables, digital displays and electronic modules.

With Việt Nam’s domestic automotive market reaching a scale considered attractive for long-term investment, industry experts are calling for a coordinated and strategic push to develop the entire automotive supply chain. This includes not only attracting foreign direct investment (FDI) but also strengthening the role of local enterprises, particularly small and medium-sized businesses in the ecosystem.

SMEs at the forefront of transformation

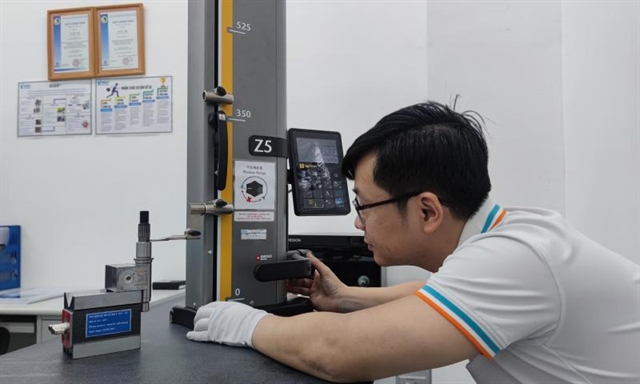

Among those is An Thinh Technology Co, a Vietnamese SME located in the Tân Thuận Export Processing Zone in HCM City.

Founded in 2007, An Thinh began as a manufacturer of household electrical items such as sockets, plugs and power cords. It was not until 2019 that the company pivoted into automotive, producing wiring components and car jacks for both domestic and international brands. Since then, its sales have grown by double digits annually.

Nguyễn Khánh Linh from An Thinh Technology Co explained that the shift required more than new equipment. The biggest challenge was changing the mindset of the engineering team to meet the automotive industry’s strict quality standards, he told saigontimes.vn.

In Đồng Nai Province’s Giang Điền Industrial Park, another SME, Vnines Innovation, is making its mark. Founded in 2020, the company focuses on electric motors, controllers and electronic modules for electric vehicles (EVs) and motorbikes.

According to the deputy director of Vnines' quality management department, Hồ Khắc Tú, his company already supplies major domestic automakers and exports to markets in North America, Europe and Asia.

Amphenol RF Vietnam, located in Tân Kim Industrial Park in Tây Ninh Province, is one of the newest entrants to the sector. The factory was established in May 2024 following a strategic decision by its US-based parent company to relocate production from China to Việt Nam, Plant Manager Nguyễn Phước Hiền told saigontimes.vn.

Hiền noted that the facility specialises in assembling RF connectors and RF cables for automobiles.

Industry experts say the growing participation of SMEs is the clearest indicator of Việt Nam’s advancing auto parts industry.

'Thousand-mile' leap in certification and capability

Việt Nam's automotive supply chain is not only expanding, it is maturing. As of May 20, 2025, Việt Nam had 858 enterprises and manufacturing facilities certified to the International Automotive Task Force (IATF) standards, up from just 38 facilities a mere 18 months earlier, according to data from the Việt Nam Association for Supporting Industries (VASI). This represents an astonishing 22-fold increase in a short span.

Việt Nam now ranks second in Southeast Asia, trailing only Thailand (1,947) and ranking ahead of Malaysia (639). On a broader regional scale, Việt Nam is now seventh out of eight countries in Asia listed by IATF that have more than 500 certified facilities.

Official data from the Ministry of Industry and Trade offers further insight. As of April 2025, more than 360 Vietnamese companies were directly involved in the automotive supply chain.

When indirect suppliers are included, the ecosystem expands to around 5,000 companies. Of them, 70 per cent supply only domestic manufacturers, 8 per cent serve foreign firms and 17 per cent supply both.

In total, 25 per cent of Vietnamese enterprises now participate in the global automotive supply chain, reflecting the industry’s growing integration with international markets.

According to the executive director of Certification, Training and Assessment at SGS Vietnam, Nguyễn Nam Trân, meeting IATF standards opens the door to new markets for Vietnamese suppliers.

Aiming higher

Industry insiders said as Việt Nam's car sales approach the critical threshold of 500,000 units annually, local and foreign automotive suppliers are showing increased interest in expanding operations, signalling a turning point for the country's auto parts industry.

An Thinh Technology Co said that it aims to begin producing car wiring harnesses in the near future. A wiring harness for a gasoline or electric car can require the participation of up to 10 companies. The firm said it plans to expand its factory, pending approval from a foreign carmaker.

Meanwhile, Tú from Vnines Innovation revealed plans to increase factory capacity, boost output and diversify into components for electric vehicles and motorbikes.

SMEs in Việt Nam’s auto parts sector are beginning to pursue their own ambitious goals, but challenges remain along the way.

For Amphenol RF Vietnam, a major obstacle is talent. As the company plans to expand its factory workforce from 60 to 100 employees by the end of the year, sourcing skilled labour remains challenging, given that most workers in the surrounding Long An area come from agricultural backgrounds.

At An Thinh, the primary challenge is maintaining compliance with increasingly stringent environmental standards. Accurately measuring greenhouse gas emissions to meet customer requirements has proven to be a complex task. Still, the company – like many others – believes that what was once just a dream is now an achievable milestone for those bold enough to take the leap.

Việt Nam's auto parts industry is on a fast track to growth, with the market valued at US$4.5 billion in 2023 and projected to exceed $13 billion by 2032. The data comes from a recent report by US-based firm Research and Markets. — VNS