While Việt Nam’s economy has made impressive strides in recent decades, the question now is how to mobilise capital, especially for private businesses that are increasingly expected to shoulder the responsibility of driving innovation, job creation, and international integration.

As Việt Nam charts a course toward becoming a high-income nation by 2045, one critical requirement is the robust development of its private sector.

Recognising this, the Politburo of the Communist Party of Việt Nam on May 25, 2025 issued a resolution on private economic development, known as Resolution 68, setting out a roadmap demanding pivotal changes, with a particular focus on ensuring sustainable, long-term capital flows for private enterprises.

While Việt Nam’s economy has made impressive strides in recent decades, the question now is how to mobilise capital, especially for private businesses that are increasingly expected to shoulder the responsibility of driving innovation, job creation, and international integration.

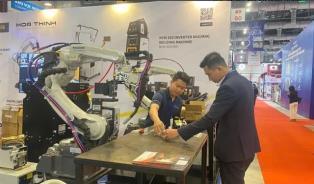

Key infrastructure projects, industrial modernisation, and tech-driven business models all require long-term capital commitments - the kind of financial support not readily available through current means.

To date, bank credit remains the primary funding source for most Vietnamese businesses. However, this route is fraught with limitations. Bank loans are predominantly short-term and come with a cautious appetite for risk, which restricts their utility for enterprises seeking stable, growth-oriented funding.

Similarly, overreliance on the state budget or foreign capital presents issues related to fiscal sustainability and national financial autonomy.

In response, Việt Nam is beginning to embrace a new strategy: building a solid domestic capital base through policy reforms and the development of domestic financial institutions. This approach, outlined in Resolution 68, underscores the need for capital flows from society and highlights the crucial role that investment funds can play.

International experience offers a valuable blueprint. Nations like Singapore and South Korea, which successfully transitioned from middle-income to high-income status, placed heavy emphasis on developing a wide array of investment funds - pension funds, infrastructure funds, national wealth funds, and more.

These funds do more than just provide capital - they create economic resilience. According to Don Lam, general director and founding shareholder of VinaCapital Group, such funding models not only supply the long-term capital necessary for infrastructure and business development, but they also help insulate the economy from global financial volatility.

In Việt Nam’s case, the demand for private equity and institutional capital is strong, driven by macroeconomic stability, a young and growing population, and increasing consumer demand. Yet, despite this potential, several bottlenecks continue to hinder capital flow into the private economy.

A primary obstacle is Việt Nam’s incomplete legal framework for private equity funds. As a result, capital mobilisation channels remain underdeveloped.

This particularly affects small and medium-sized enterprises (SMEs), many of which struggle to access bank credit due to lack of collateral, limited financial transparency, and unfamiliarity with fund participation.

From the investor’s side, hesitation stems from unclear regulations and insufficient market infrastructure. On the enterprise side, strategic shortcomings and internal weaknesses continue to deter investment. As Lam suggests, unlocking this capital will require immediate reforms.

Among his proposals are the creation of supplementary pension funds and the establishment of infrastructure investment vehicles, similar to real estate investment trusts used globally. These tools could provide much-needed long-term, sustainable capital from domestic sources.

Another critical issue lies in the underdevelopment of Việt Nam’s listed market. Despite repeated efforts by state agencies, the number of public enterprises remains modest - fewer than 2,000 companies are listed, and IPO activity has been sluggish since 2019.

But quantity isn’t the only issue. The quality of governance among public enterprises must also be improved. In an era when sustainability, environmental, and social governance are global business standards, Vietnamese enterprises must adopt better auditing, reporting, and management practices.

By doing so, the country can build a transparent, globally integrated capital market capable of attracting high-quality investors.

According to Lam, expanding the number and quality of listed enterprises is not just a financial objective - it’s a strategic move that supports the development of a resilient, efficient, and internationally competitive financial ecosystem.

Focus on SMEs

SMEs represent the backbone of Việt Nam’s economy, yet they continue to face persistent barriers to capital access. A 2024 survey by the Hanoi Association of Small and Medium Enterprises found that 67 per cent of respondents encountered difficulties accessing loans. The top reasons included: lack of collateral, high interest rates, and lengthy, complicated approval processes.

To address this, Việt Nam could look to international best practices. In many countries, project-based lending models allow SMEs to secure funding based on business feasibility rather than fixed asset collateral. Additionally, targeted support funds or credit guarantees could significantly improve SMEs’ access to capital.

A deeper issue affecting capital flow is the unequal policy environment between domestic private enterprises and foreign direct investment firms.

According to Ngô Thắng Lợi, PhD, nearly 85 per cent of such firms are located in prime land zones, while private Vietnamese businesses often struggle to access similar advantages in land, credit, and policy support.

Trần Văn Thế, chairman of InDel Investment and Development Company, notes that many businesses suffer from weak competitiveness, thin capital, and non-transparent financial records. These shortcomings make it harder to attract capital and participate in long-term growth strategies.

Moreover, Việt Nam’s legal and administrative systems still lack coherence and efficiency. Enterprises face long approval processes to get permission to implement projects. The lack of specific guidance at the local level has delayed making critical decisions and also implementation.

To unlock the full potential of the private sector, Việt Nam must create a genuinely level playing ground. Policy equality is not just about eliminating discrimination - it’s about building a fair, transparent, and adaptive environment where all types of enterprises can access opportunities and resources equitably.

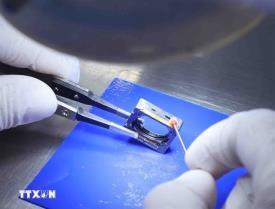

This also includes updating Việt Nam’s capital mobilisation methods to embrace digital tools. Fintech solutions, digital platforms, and blockchain technologies can help democratise access to investment while enhancing transparency and regulatory control.

Việt Nam’s private economic sector is one of the backbones of the national economy. With over 940,000 registered enterprises and more than 5 million business households in active operation, this sector plays a central role in fuelling economic momentum.

The private businesses contribute approximately half of the country’s GDP, account for more than 30 per cent of total state budget revenue, and - perhaps most significantly - employ around 82 per cent of the national workforce.

Beyond these quantitative contributions, the private sector is also a major driver of innovation, helping to improve labour productivity and enhance Việt Nam’s global competitiveness.

As private enterprises continue to expand and modernise, many have successfully built strong domestic brands and made inroads into regional and international markets.

Their growing presence on the global stage not only boosts Việt Nam’s export capacity but also raises the country’s profile as a competitive, innovation-oriented economy.

Moreover, by engaging millions of entrepreneurs and small business owners across the country, the private sector has a direct impact on social stability, helping to eradicate hunger and reduce poverty in both urban and rural areas. VNS