Việt Nam continues to be a reliable destination for investors thanks to its stable macroeconomic environment, consistent investment policies and improving capacity in electronics and component manufacturing.

A wave of large-scale foreign projects approved in November has strengthened Việt Nam’s foreign direct investment momentum, underscoring the country’s growing appeal to global investors seeking stability, scale and long-term returns in a volatile international environment.

Notable examples include the AEON MALL Biên Hòa commercial centre project in Đồng Nai Province, with total investment of US$261.1 million by Japan’s AEON Group; the Phú Mỹ 3 chemical production project in HCM City, worth $203.6 million, by Lee & Man Chemical Co Ltd (Hong Kong, China); and the STABOO Thanh Hóa OSB bamboo board manufacturing project, valued at $150 million, by Switzerland’s STABOO JSC.

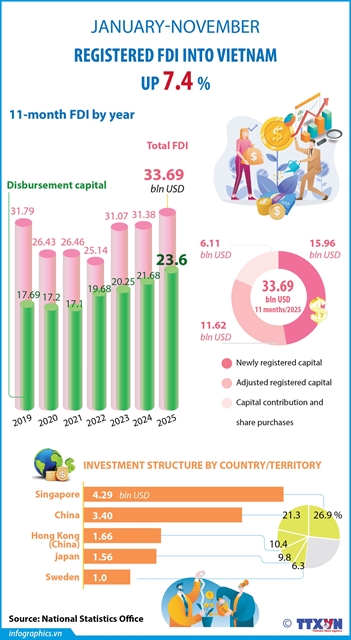

Together, these projects helped lift Việt Nam’s total registered FDI in the 11 months to $33.69 billion, up 7.4 per cent year on year. Disbursed FDI reached a record $23.6 billion, rising 8.9 per cent over the same period.

In its 11-month FDI report, the Foreign Investment Agency (FIA) under the Ministry of Finance notes that the global investment environment continues to be affected by complex economic and geopolitical factors. These pressures are prompting global capital flows to prioritise markets with stable macroeconomic fundamentals and strong absorption capacity.

Amid a broader trend of capital contraction and restructuring, the Asia–Pacific region remains an attractive destination thanks to sustained demand in electronics, semiconductors and technology, particularly in Việt Nam, Thailand and Malaysia.

According to FIA, Việt Nam continues to be regarded a reliable destination for foreign investors, thanks to its stable macroeconomic environment, consistent investment policies and steadily improving capacity in electronics and component manufacturing.

However, as production relocation to Southeast Asia accelerates and competition for FDI intensifies, Việt Nam faces mounting pressure from regional rivals such as India, Malaysia and Indonesia, which are offering aggressive tax incentives and developing specialised industrial parks tailored to strategic industries.

This reality is pushing Việt Nam to shift its focus from attracting large volumes of capital to securing high-quality investment, prioritising core technologies, innovation, value-chain linkages and higher localisation rates.

This transition has already been identified as a strategic direction. Minister of Finance Nguyễn Văn Thắng has repeatedly stressed that Việt Nam must prioritise high-tech and innovation-driven projects if it aims to become a developed country by 2045.

Việt Nam would focus on attracting high-tech, innovative, high value-added and environmentally friendly projects, rather than pursuing quantity at all costs, he said.

The recent adoption of the amended Law on High Technology and the revised Law on Investment by the National Assembly is expected to provide a significant institutional boost. These laws introduce important reforms, including reduced pre-licensing procedures, a stronger shift to post-inspection, simplified registration and notification mechanisms, a narrower list of conditional business lines, and enhanced incentives for high technology, innovation and green growth.

Emerging destinations

FDI attraction in 2025 has maintained a positive momentum, underscoring Việt Nam’s sustained appeal amid global fragmentation. According to FIA, healthy levels of registered and disbursed capital are reinforcing investor confidence and laying a foundation for further acceleration into 2026.

At the Việt Nam M&A Forum, Tamotsu Majima, senior director of RECOF Corporation, said that Việt Nam’s solid growth outlook, extensive network of new-generation free trade agreements, and expanding strategic partnerships had created confidence and significant opportunities for multinational corporations.

Meanwhile, Deputy Minister of Finance Trần Quốc Phương recently said that the ministry was developing a scheme on foreign-invested economic development alongside a new-generation FDI attraction strategy.

With more open, attractive and competitive policies, these initiatives are expected to help Việt Nam achieve a substantive shift from capital volume to investment quality.

At the same time, FDI disbursement in Việt Nam has reached its highest level in five years, creating fresh momentum for the country’s integrated facilities management (IFM) market and positioning Việt Nam as a standout performer among emerging IFM destinations, according to experts from Savills Việt Nam.

Integrated facilities management is a comprehensive model for managing facilities, combining technical operations, equipment maintenance, energy management, security, cleaning and other support services, helping businesses enhance operational efficiency, optimise costs and comply with international environmental, social and governance (ESG) standards.

The continued strength of foreign investment inflows in the first 11 months of 2025, with $23.6 billion in disbursed capital – the highest in five years – is creating a solid foundation for growing demand for IFM services across factories, logistics centres and office buildings, particularly as foreign investors continue to expand production in Việt Nam.

According to Mordor Intelligence, the global IFM market is on a strong upward trajectory, projected to reach $270 billion by 2030. The Asia-Pacific region is expected to remain a key growth engine thanks to rapid industrial expansion, fast urbanisation and accelerated digital transformation.

Against this backdrop, Việt Nam has emerged as one of the brightest markets in ASEAN’s rapidly developing IFM landscape, with estimated annual growth of 7-9 per cent in the commercial and industrial segments – higher than the global average.

Experts from Savills Việt Nam observe that the domestic market is shifting rapidly from single-service contracts to more comprehensive and efficient IFM solutions. The outsourced IFM segment has recorded the fastest growth, with a compound annual growth rate of 7.8 per cent, as businesses increasingly partner with specialised service providers to improve efficiency and operational quality.

Luca Vadala, national head of Business Development, Integrated Facility Management at Savills Việt Nam, said that the Vietnamese IFM market was forecast to double in size by 2030, reaching an estimated value of around $662 billion. VNA/VNS

- Tags

- FDI