Compared to the beginning of October, the US dollar price listed at banks decreases by about VNĐ94, but it increases very strongly by VNĐ1,100 in the unofficial market.

HÀ NỘI — After several days of rapid increases, the US dollar’s rise on the unofficial market has stalled following a move by the State Bank of Vietnam (SBV) to tighten supervision and urge ministries to strengthen inspection and management of foreign exchange activities.

On Monday, the dollar traded at VNĐ27,550 for buying and VNĐ27,700 for selling on the unofficial market, unchanged from the previous day.

At commercial banks, the dollar has also held steady in recent days, trading around VNĐ26,112 for buying and VNĐ26,352 for selling. Compared with early October, the bank-listed price has fallen by about VNĐ94, while the unofficial market rate has surged by roughly VNĐ1,100 and at times approached VNĐ28,000.

To stabilise the forex market, the SBV has issued a document calling on the Ministry of Public Security, the Ministry of Industry and Trade and the Government Inspectorate to enhance coordination in managing foreign exchange activities to safeguard the banking system and maintain macroeconomic stability.

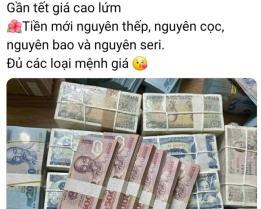

The SBV has asked the Ministry of Public Security to direct relevant forces to identify and strictly handle illegal foreign currency trading, particularly speculation, hoarding and exchange of dollars outside authorised channels.

The Ministry of Industry and Trade has been tasked with inspecting foreign currency use in import and export payments to ensure compliance with regulations.

In addition, the Government Inspectorate has been requested to review and monitor organisations and individuals showing signs of violations, and share information promptly with the SBV for timely intervention.

The SBV said closer coordination is needed as the unofficial market has shown strong volatility. When its rate exceeds official levels, people may switch to holding dollars instead of saving in đồng, which can tighten liquidity and hinder monetary policy management.

The central bank noted that the exchange rate gap between the banking system and the unofficial market has widened significantly. This reflects global dollar strength and a rising tendency to hold foreign currency in Việt Nam, as the US Federal Reserve continues its high interest rate stance and year-end international payment demand increases.

In response, the SBV has proactively and flexibly managed the central exchange rate and instructed credit institutions to strictly follow regulations on foreign exchange services.

Commenting on the widening gap, Nguyễn Danh Thái, an expert in the Macroeconomics Division of CKG Vietnam Company, said the unofficial market price reflects real demand and short-term sentiment.

He noted that both investors and the public have been increasing dollar holdings amid high domestic and international gold prices, boosting demand for dollars used to smuggle gold. This has pushed the unofficial rate up faster than the official rate.

“The dollar price in the unofficial market has increased rapidly due to real demand and defensive sentiment, while the rate in the official market has remained stable thanks to the SBV's regulated supply and flexible policy. The current gap between the two markets mainly reflects short-term market expectations of a speculative nature,” Thái said.

In the longer term, he added, the SBV must continue operating flexibly while maintaining strong inflows of dollar capital from trade surpluses, foreign direct and indirect investment, and remittances to narrow the exchange rate gap. — BIZHUB/VNS

- Tags

- exchange rate