Given the current environment, the appetite for buying appears riskier than potential opportunities.

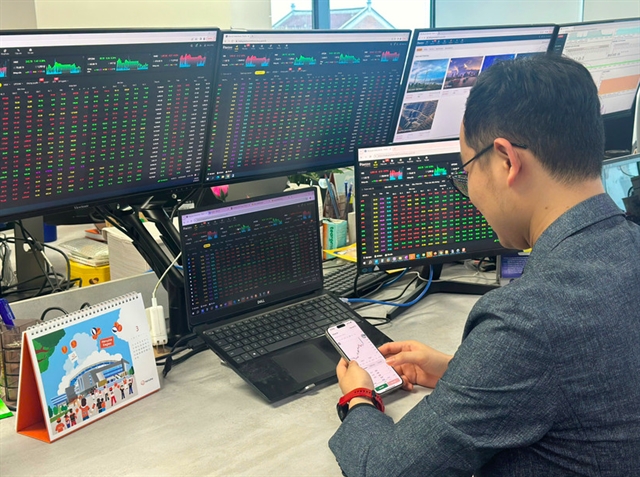

HÀ NỘI — The Vietnamese stock market kicked off February with a tumultuous trading week characterised by rising selling pressure, especially among large-cap stocks, amid a backdrop of cautious investor sentiment and persistent foreign net sell-offs.

The VN-Index, representing the HoChiMinh Stock Exchange (HoSE), slipped below the psychological threshold of 1,800 points, marking its third consecutive week of declines.

Continuing the downward trend that began in late January, the VN-Index opened the first trading session of the month with a significant drop of over 22 points.

By the end of the week, the market benchmark had shed a total of 73.55 points, a decrease of 4.02 per cent, closing at 1,755.49 points.

This marked a clear downtrend after briefly surpassing the 1,900-point mark on January 22.

Market liquidity saw a slight increase, reaching nearly VNĐ160 trillion (US$6.2 billion), an 8.8 per cent rise from the previous week, with an average trading volume of about 900 million shares per session, up 7.6 per cent.

The primary pressure on the index was concentrated among key pillar stocks. The Vin trio stocks, Vingroup (VIC), Vinhomes (VHM) and Vinpearl (VPL), were significant detractors, collectively causing the VN-Index to fall by nearly 23 points.

Additionally, large banks such as Vietcombank (VCB) and BIDV (BID) contributed 9.1 and 3.5 points to the decline, respectively.

The HNX-Index on the Hanoi Stock Exchange (HNX) closed the week at 256.28 points, a modest increase of 0.15 points, or 0.06 per cent, compared to the previous week.

Liquidity on the HNX improved significantly, with total trading value for the week reaching over VNĐ11.4 trillion, up 11.23 per cent from the prior week.

Foreign trading activity remained a significant concern for the market. Foreign investors sold off shares across all five trading sessions during the week, resulting in net sales of over VNĐ6.3 trillion across both exchanges.

Specifically, the HoSE faced a net sell-off of over VNĐ6.4 trillion, while the HNX saw foreign investors net buy VNĐ116 billion. For this year to date, foreign investors have sold almost VNĐ13 trillion.

According to Vietnam Construction Securities Corporation (CSI), the mounting selling pressure is indicative of increased caution in the market as the Tết (Lunar New Year) holiday approaches.

The continuing decline in the VN-Index, marked by three consecutive downturn sessions and increasing liquidity, suggests there is no immediate end in sight for the selling pressure. The index has fallen below the critical 1,800-point level on the weekly chart, reflecting negative investor sentiment.

CSI forecasts that the VN-Index is likely to test the support level around 1,740 points, with the possibility of breaching this support and heading towards lower levels.

Given the current environment, the appetite for buying appears riskier than potential opportunities. Investors are advised to prioritise risk management, avoid bottom-fishing strategies and consider reducing positions during any market recoveries.

From a cautious perspective, Saigon-Hanoi Securities (SHS) said that the VN-Index is under significant pressure to adjust towards the range of 1,700-1,730 points, aligning with the average price levels over the past 100 to 120 sessions.

This zone serves as vital support connecting the lows from November and December 2025.

Given the increasing uncertainty due to risks like asset bubbles (in cryptocurrencies and precious metals), declining credit growth, rising deposit and lending rates and instability in global financial markets, SHS emphasised short-term risk management as a key focus.

However, some experts remain optimistic about a potential technical rebound after three weeks of intense adjustments, especially as the index approaches oversold territory. Valuation metrics are also becoming increasingly attractive.

VNDirect Securities reported that the price-to-earnings (P/E) ratio of the VN-Index has dropped to 14.69, the lowest figure in nearly two months.

Despite the challenges in the domestic market, data from FiinGroup indicates that total profits after tax of listed companies increased by 31.3 per cent in the fourth quarter of 2025 and by 29.7 per cent for the entire year, suggesting that profit fundamentals remain positive.

This could present medium- to long-term investment opportunities as short-term risks gradually subside. — BIZHUB/VNS