The VN-Index could see a 15–20 per cent upside over the next 12–18 months following Việt Nam’s market upgrade, according to VinaCapital Fund Management JSC.

HCM CITY — The VN-Index could see a 15–20 per cent upside over the next 12–18 months following Việt Nam’s market upgrade, according to VinaCapital Fund Management JSC.

On October 8, FTSE Russell announced the reclassification of Việt Nam from Frontier to Secondary Emerging Market status, effective from September 21 next year.

Its index governance board said Việt Nam meets all criteria for Secondary EM status though it offers only limited access for global brokers, which, though not a formal criterion, is a key concern for index users.

The issue will be reassessed in March 2026, when an interim review will be made.

“We are reasonably confident that Vietnamese authorities will address this issue and that the upgrade will proceed as planned in September 2026,” Vũ Ngọc Linh, head of research at VinaCapital, said.

The upgrade recognised the Government’s consistent reform efforts in recent years, including investing in technological infrastructure, introducing new financial products, strengthening regulatory frameworks, enhancing corporate transparency, and improving market access for foreign investors.

While Việt Nam has seen net capital outflows of US$8.5 billion over the past three years, the reclassification could mark a turning point, helping attract foreign inflows from EM funds, Linh said.

She said the announcement should not be seen as an endpoint but rather a new beginning, bringing both opportunities and challenges.

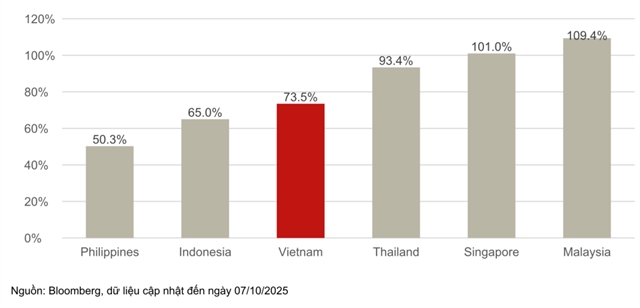

Việt Nam’s goal is to expand by 2030 stock market capitalisation to 120 per cent of GDP from the current 75 per cent.

VinaCapital estimated that the upgrade could bring $5–6 billion in capital inflows.

Việt Nam is expected to be included in the FTSE EM All Cap Index, which has approximately $100 billion in tracking assets.

The country could represent 0.3 per cent of the index, equivalent to $300 million in passive inflows with 30 stocks to be included.

In all, it could receive around $1 billion in passive and $4–5 billion in active inflows.

While modest in absolute terms, they represent a meaningful shift for Việt Nam, particularly after three consecutive years of net foreign outflows.

Such inflows would improve market liquidity, bolster investor confidence, and support the long-term development of Việt Nam’s capital markets, Linh noted.

Beyond the EM upgrade

Achieving EM status is a milestone, but sustaining it will require additional comprehensive reforms to modernise and strengthen market resilience, according to VinaCapital.

Key next steps include establishing a Central Counterparty (CCP) system by end-2026, improving foreign investor access, better sector diversification, and more high-quality IPOs.

While the non-prefunding model provides an interim measure to support the FTSE upgrade, the establishment of a CCP system constitutes a long-term solution.

In alignment with MSCI standards, the Government has outlined plans to establish a CCP subsidiary under the Vietnam Securities Depository and Clearing Corporation, with the necessary legal and institutional framework expected to be completed by the end of 2026 and the system going live in early 2027.

Gradually lifting foreign ownership limits is also essential to improve accessibility.

Equally important is developing a regulatory framework for FX hedging instruments, which will allow long-term institutional investors to better manage currency risks.

Other priorities include improving English-language disclosures and standardising market data to enhance transparency and investor confidence.

Việt Nam’s stock market is now heavily concentrated in financials (37 per cent) and real estate (19 per cent).

Broader sector diversification would better reflect the economy’s structure and reduce reliance on these two sectors.

A new wave of IPOs is expected to boost market capitalisation and help rebalance the stock market’s industry composition.

“As market participants, our outlook is positive,” Linh said.

“Việt Nam’s stock market still trades at an undemanding valuation of 13x forward P/E. Amid the market upgrade, we believe the VN-Index’s valuation offers 15-20 per cent upside in the next 12-18 months.

“This reflects Việt Nam’s optimistic economic prospects, supportive government policies, approximately 15 per cent corporate earnings growth expected over the next 1-2 years, and a potential valuation re-rating of the VN-Index post-EM upgrade.” — VNS