Việt Nam remains prime destination for industrial investors thanks to ESG commitments

The country's industrial real estate market has been undergoing a significant transformation, not only in terms of scale but also in quality and a focus on sustainability.

HCM CITY — Việt Nam is solidifying its position as a prime destination for global industrial investment, thanks in part to a strong commitment to Environmental, Social, and Governance (ESG) demonstrated by developers with the support of consulting firms, experts have noted.

In recent years, the country's industrial real estate market has been undergoing a significant transformation, not only in terms of scale but also in quality and a focus on sustainability. Both domestic and international developers are closely attuned to the evolving needs of manufacturers to construct adaptable and efficient facilities.

This transformative shift is taking place against the backdrop of a series of significant disruptions faced by global supply chains, from financial crises and the COVID-19 pandemic to extreme weather events and protectionist trade policies such as unilateral tariffs. These disruptions have highlighted the vulnerabilities of complex logistics systems that span multiple countries.

“While the outcome of the latest tariff tension remains uncertain, Việt Nam has received positive indications, with the most favourable scenario suggesting an actual tax rate of around 20 per cent. This would enable Vietnamese goods to maintain a competitive edge over China, and even some other countries in the region. We believe that Việt Nam continues to benefit significantly as global manufacturers seek to diversify and build more resilient supply chains,” said Trang Bùi, country head of Cushman & Wakefield Vietnam.

Industrial real estate now stands as a strategic cornerstone, playing a vital role in sustaining global production and distribution. In particular, the "green transition" spearheaded by industrial developers is emerging as a key competitive edge, as an increasing number of global enterprises prioritise infrastructure aligned with ESG standards.

A survey by Cushman & Wakefield reveals that “sustainability” now ranks among the top three priorities for businesses when selecting commercial real estate.

Companies are no longer just seeking efficient production spaces; they are also looking for infrastructure that supports their long-term sustainability commitments.

In detail, over 70 per cent of respondents are willing to pay a rental premium — ranging from 7 per cent to 10 per cent — to occupy green-certified buildings as part of their emissions reduction goals.

Việt Nam is emerging as one of the few countries that offer a comprehensive set of competitive advantages in this regard. Although industrial rental prices in 2025 have increased by 70 per cent compared to 2019, the average rate remains attractive relative to other regional markets, ranging from $4 to $7 per square metre per month.

The total supply of industrial space has surpassed 11 million square metres — an increase of approximately 113 per cent since 2019 — with occupancy rates hovering between 85 per cent and 90 per cent.

Labour costs in Việt Nam are currently only about 25 per cent of the global median wage, placing the country among the lowest-cost labour markets in the Asia-Pacific region. Additionally, Việt Nam ranks third globally for the lowest industrial electricity prices.

In addition, Việt Nam’s strong commitment to sustainable development was clearly demonstrated at COP26, where the Prime Minister pledged to achieve net-zero emissions by 2050. Since then, several key policies have been enacted, including Decree 06/2022/ND-CP and Decision 280/QD-TTg, aimed at promoting energy efficiency and conservation.

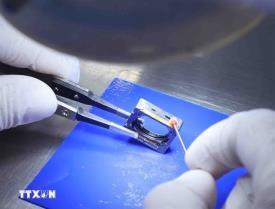

An exceptional recent illustration is the ready-built factory project KTG Industrial at VSIP Bắc Ninh 2, deliberately designed and developed with a clear ESG focus and in alignment with LEED Gold certification standards from the outset. This mirrors the resolute commitment of industrial developers to long-term operational efficacy and environmental responsibility.

Đặng Trọng Đức, CEO at KTG Industrial, said: “We made a conscious effort to incorporate the project’s sustainability vision from the outset - not only to uphold quality standards but also to deliver tangible benefits to manufacturers. KTG Industrial factories are designed to support safer and healthier working environments and align with evolving carbon reduction standards globally."

The 14-hectare project is equipped with LED lighting systems, water-saving fixtures, skylights to maximise natural daylight, and rooftops ready for solar panel installation. Green spaces are thoughtfully integrated to improve air quality and comfort.

As of 2025, Việt Nam has become a strategic destination for many of the world’s leading corporations in technology—such as Samsung, Intel, LG, Foxconn, Amkor Technology, NVIDIA, and Toyota—as well as for consumer goods manufacturers like Unilever and P&G, and contract manufacturers such as Nike, Adidas, Puma, and Decathlon.

Trang Bùi noted: “Today’s investors plan short-term investments based on an overarching asset strategy, while also aiming for long-term goals. Assets with a clear carbon history and a sustainable development roadmap will always be more attractive than those lacking medium- or long-term direction.” — VNS