VIB said its asset quality continued to improve, supported by effective risk management and prudent operational controls maintained at an optimal level.

HÀ NỘI — Vietnam International Bank (VIB) announced its business results for the first nine months of 2025, reporting a pre-tax profit of over VNĐ7.04 trillion (US$267.5 million), up 7 per cent compared to the same period in 2024.

The bank reported strong business performance with credit growth reaching 15 per cent and deposit growth at 11 per cent. VIB said its asset quality continued to improve, supported by effective risk management and prudent operational controls maintained at an optimal level.

As of September 30, the bank’s total assets surpassed VNĐ543 trillion, marking a 10 per cent increase compared to the beginning of the year.

Credit outstanding reached nearly VNĐ373 trillion, up 15 per cent year-to-date, driven by balanced contributions from its three key business segments, retail banking, corporate banking and institutional banking.

In retail banking, VIB continued to selectively expand lending activities, focusing on core products such as home loans, auto loans, business loans and credit cards. The bank maintained a strategic emphasis on serving high-quality customers with well-secured and fully compliant assets.

Meanwhile, in the corporate and institutional banking segments, VIB recorded accelerated growth in working capital loans, production and business loans, and project financing for reputable enterprises with strong financial capacity and sustainable growth prospects.

Customer deposits at VIB also saw robust growth, increasing more than 11 per cent to nearly VNĐ308 trillion. CASA (current and savings account) balances and Super Interest accounts surged by 39 per cent year-to-date, reflecting the success of the bank’s strategy to optimise idle funds and strengthen liquidity.

In the third quarter of 2025, VIB introduced an innovative combined solution linking its Super Account with the Smart Card cash-back payment card under the theme 'Leading the Profitability Trend.' The initiative allows customers to maximise the value of both idle funds and everyday spending, offering combined benefits of up to 9.3 per cent.

VIB described this 'Smart Duo' product as a milestone in reshaping Vietnamese consumer behaviour, empowering clients to fully leverage the earning potential of every unit of capital while promoting smarter cash flow management.

VIB also reported continued improvement in asset quality during the third quarter of 2025. The bank’s non-performing loan (NPL) ratio fell to 2.45 per cent, down 0.23 percentage points compared to the end of the first quarter, reflecting the effectiveness of its prudent credit policies and focus on high-quality borrowers.

The loan portfolio remains well balanced, with more than 73 per cent of total outstanding loans concentrated in the retail and SME segments. Over 90 per cent of retail loans are secured by fully legal real estate assets, primarily located in major urban centres.

The remaining 27 per cent of the portfolio is allocated to corporate and institutional banking, focusing on leading enterprises across sectors, including foreign direct investment (FDI) firms, state-owned enterprises and top private companies.

In the third quarter of 2025, VIB issued a 14 per cent stock dividend and completed a total dividend payout of 21 per cent in cash and shares, as approved at the bank’s 2025 Annual General Meeting of Shareholders.

The bank’s key safety and risk management indicators remained at healthy and optimal levels. Its Capital Adequacy Ratio (CAR) under Basel II stood at 12.4 per cent, well above the regulatory minimum of 8 per cent. The Loan-to-Deposit Ratio (LDR) was 79 per cent, below the regulatory ceiling of 85 per cent, while the ratio of short-term funding used for medium- and long-term loans was 27 per cent, under the 30 per cent regulatory limit.

Additionally, VIB’s Net Stable Funding Ratio (NSFR) under Basel III reached 107 per cent, surpassing the Basel III requirement of 100 per cent.

Nine-month profit drives revenue diversification

In the January-September period, VIB recorded total operating income of over VNĐ14.7 trillion and pre-tax profit exceeding VNĐ7.04 trillion, up 7 per cent year-on-year.

Net interest income reached nearly VNĐ11.9 trillion, remaining the bank’s main revenue driver as it expanded lending across all customer segments at competitive interest rates with a focus on high-quality clients holding well-secured assets.

In line with the Government’s directive to support credit access, VIB maintained lending rates at reasonable levels, contributing to economic recovery. The bank’s net interest margin (NIM) stood at 3.2 per cent, reflecting a balance between profitability and asset quality.

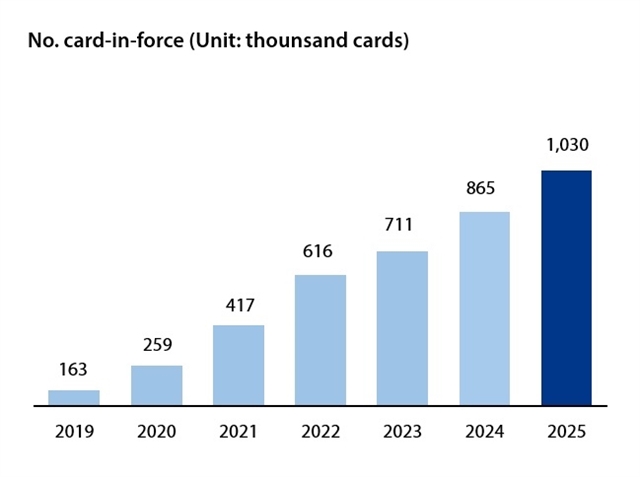

Non-interest income accounted for over 19 per cent of total operating income, primarily fuelled by fees and service activities. By September 30, VIB had issued more than one million credit cards, with total spending in the first nine months exceeding VNĐ104 trillion, marking a 15 per cent year-on-year increase.

The bank’s recently launched digital banking services, including bill payments, international transfers and tuition and insurance payments, alongside tailored solutions for corporate clients, also contributed significantly to fee and service income.

Operating expenses for the first nine months of 2025 totalled approximately VNĐ5.46 trillion, remaining largely unchanged from the same period last year. The stability was attributed to the coordinated implementation of process optimisation measures and effective cost management.

Credit risk provisioning declined by 31 per cent year-on-year, reflecting prudent provisioning in previous quarters and an improvement in the quality of the bank’s assets.

Completing a comprehensive financial ecosystem, enhancing the customer experience

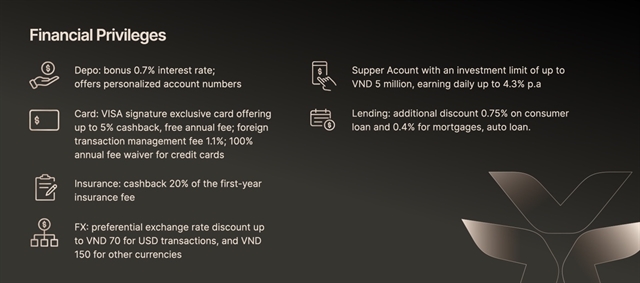

Responding to customer demand for comprehensive financial solutions, VIB officially launched Privilege Banking, a priority service programme designed to support clients in building and growing wealth.

Positioned under the motto 'Value is measured not only by assets but by experience,' Privilege Banking combines financial benefits, lifestyle perks and premium services, marking a significant milestone in VIB’s leadership in Việt Nam’s priority banking segment.

In the third quarter, VIB received three prestigious awards from Visa at the 2025 Visa Vietnam Customer Conference, recognising its technological innovation, transaction volume growth and corporate card development.

Awards included Digital Pioneer – leading the deployment of new digital solutions in Việt Nam with the PayFlex feature; Payment Volume Growth – exceptional growth in card transaction volume, achieving a 100 per cent increase; and Supply Chain Payment & Commercial Card Innovation 2025 – pioneering supply chain payments and corporate card innovation with the VIB Business Card.

With a solid financial foundation, high-quality credit portfolio and a comprehensive digital ecosystem, VIB is well-positioned to accelerate growth in the fourth quarter, aiming to achieve its 2025 targets and continue delivering sustainable value to customers, shareholders and the Vietnamese economy. — VNS