The VN50 Growth Index includes 50 selected stocks from the VNAllshare Index, chosen based on stringent criteria, while the VNMITECH Index focuses on modern industrial and technology stocks.

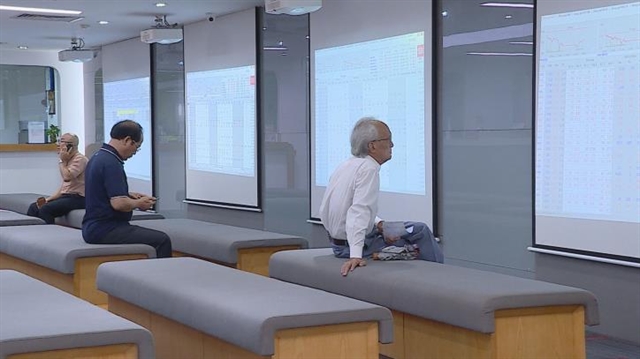

HÀ NỘI — The Ho Chi Minh Stock Exchange (HoSE) has officially launched two new investment indices, the VN50 Growth Index and the VNMITECH Index.

These indices are designed to enhance investment opportunities in the Vietnamese stock market and reflect the dynamic growth of specific sectors.

The VN50 Growth Index includes 50 selected stocks from the VNAllshare Index, chosen based on stringent criteria.

To qualify, stocks must meet a minimum free-float market capitalisation of VNĐ2 trillion (US$76.2 million) and a daily trading volume of at least VNĐ20 billion.

From the eligible stocks, the top 50 with the highest free-float market capitalisation will be included, prioritising those with higher trading volumes when capitalisations are equal.

Additionally, the index imposes limits on the capitalisation weight of individual stocks, capping it at 10 per cent, and a sector-wide cap of 40 per cent for stocks within the same industry.

This structure aims to ensure a balanced representation of companies while minimising risks associated with over-concentration.

The VNMITECH Index focuses on modern industrial and technology stocks. It consists of a minimum of 30 and a maximum of 50 stocks, selected from the VNAllshare Materials, Industrials and Information Technology indices.

The criteria for inclusion mirror those of the VN50 Growth Index, requiring a minimum free-float market capitalisation of VNĐ1.5 trillion and a daily trading volume of VNĐ20 billion.

If more than 50 stocks meet these criteria, the top 50 based on free-float market capitalisation will be selected, again prioritising trading volume when necessary.

The weight limits for individual stocks in this index are set at 15 per cent and 25 per cent for those selected from the materials sector, with no sector-wide limit for stocks from the industrial and technology sectors.

Both indices will be periodically reviewed, with evaluations taking place at the end of June and December each year. Quarterly updates will also help adjust for changes in free-float ratios, circulation volumes and other relevant metrics.

Stocks that come under a warning status, transaction restriction or temporary suspension will be removed from the indices to maintain their integrity. — BIZHUB/VNS