The market now serves as a vital channel for medium- and long-term capital, reflecting the health of the economy and the strength of enterprises.

HÀ NỘI — As Việt Nam’s stock market celebrates its 25th anniversary this month, policymakers and regulators are eyeing comprehensive reforms to enhance transparency, stability and long-term capital mobilisation.

At a recent forum titled 'Momentum for New Capital Flows' on Wednesday, officials emphasised that facilitating capital flows into the stock market is crucial for realising the country’s economic growth ambitions.

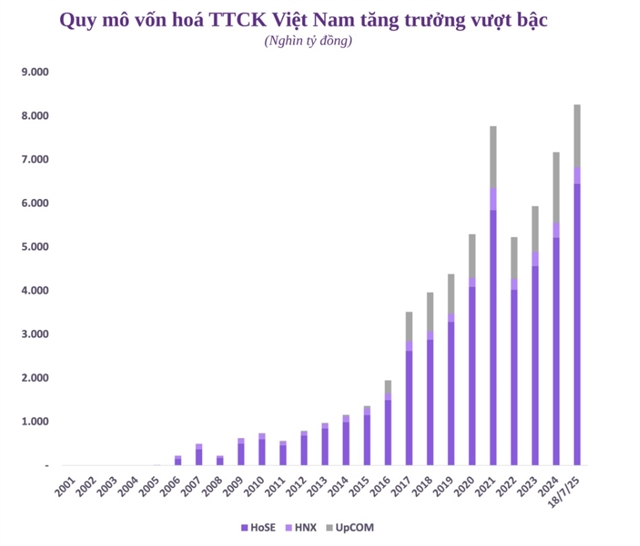

Deputy Minister of Finance Nguyễn Đức Chi said that Việt Nam’s stock market, which has grown from zero to a capitalisation exceeding 60 per cent of GDP, and at times reaching 70 per cent, now stands at a critical juncture.

"After 25 years of development, we have built a robust legal framework, market infrastructure and a diverse investor base of over 10 million accounts, both domestic and foreign," he said.

Chi highlighted that the market now serves as a vital channel for medium- and long-term capital, reflecting the health of the economy and the strength of enterprises.

"The market has evolved into a barometer for economic performance and business capacity," he said, adding that the timing is right to address legal bottlenecks and elevate market quality.

According to Chi, legislative reviews should identify specific shortcomings in the current Law on Securities (2019), as well as proposed amendments for 2024.

He urged stakeholders to clearly outline areas in need of revision to ensure timely policy adjustments. Legal clarity, he argued, will help unlock more capital sources and raise the market’s global standing.

Among the proposed solutions are the development of new financial products and the consideration of allowing foreign-invested enterprises to list on the country’s exchanges.

Enhancing the balance between institutional and retail investors was also emphasised. While institutional participation needs to increase, retail investors must be supported through improved financial literacy and investor education strategies.

Emerging market standards

Vice Chairman of the State Securities Commission (SSC) Bùi Hoàng Hải noted that Việt Nam has made significant progress toward meeting the criteria for an upgrade to emerging market status.

Hải said hard criteria have been fulfilled, but soft criteria, such as the experience of foreign investors, still depend on practical improvements in the market.

He emphasised that a market upgrade should not be viewed as the ultimate goal. The core objective remains comprehensive reform to ensure the market operates transparently, supports development and facilitates easier capital raising for investors.

Trần Anh Đào, deputy CEO in charge of operating the Ho Chi Minh Stock Exchange (HoSE), shared updates on ongoing initiatives, including aligning the IPO process with listing procedures under Decree 155.

The aim is to improve the quality and standards of listed enterprises to make them comparable with their regional peers and thereby attract more foreign capital.

She also outlined efforts to work with fund management companies to develop specialised investment indices tailored to different investor groups.

The exchange is expanding the range of indices to provide a foundation for new products and services that meet emerging market needs, she said, adding that HoSE is building a roadmap to maximise the potential of its trading infrastructure.

While Việt Nam’s stock market has achieved notable milestones over the past 25 years, the roadmap ahead demands more than celebratory reflections.

Regulatory clarity, institutional strengthening, product diversification and infrastructure enhancements are essential to mobilise new capital flows and position the market as a cornerstone of Việt Nam’s economic trajectory.

As the deputy finance minister put it, unlocking new capital is the right requirement, with the right content, at the right time for investors, enterprises and policymakers alike. — BIZHUB/VNS

- Tags

- Vietnam stock market